There’s one thing that all businesses have in common with project management: money. Without funding and the proper budgeting process, projects in any industry grind to a halt. Budgeting is how those funds are spent.

But first, let’s define what a budget is and explore the types of budgets and methods for making a budget. By understanding the budgeting process for business and project management, it’s easier to understand how to make a budget for your company or project.

What Is a Budget?

A budget is an estimate of the revenue and expenses that occur over a period of time. It’s a living document that’s reviewed and revised periodically. Any enterprise that spends money will use a budget to manage its costs, whether this is a business, project, governmental agency or even a personal household.

Another way to look at a budget is as a financial plan. It plans your spending over a specific timeframe. Using a budget is essential to undertaking any financial endeavor successfully. This is why there are corporate budgets, project budgets and government-created budgets to support various services.

A budget process outlines the resources needed for managing a business or project, but that’s not all a budget can do. It’s a tool for setting goals over the quarter or year, measuring outcomes and planning for contingencies. Whether you’re running a business or managing a project, project management software can help you plan, manage and track your budget.

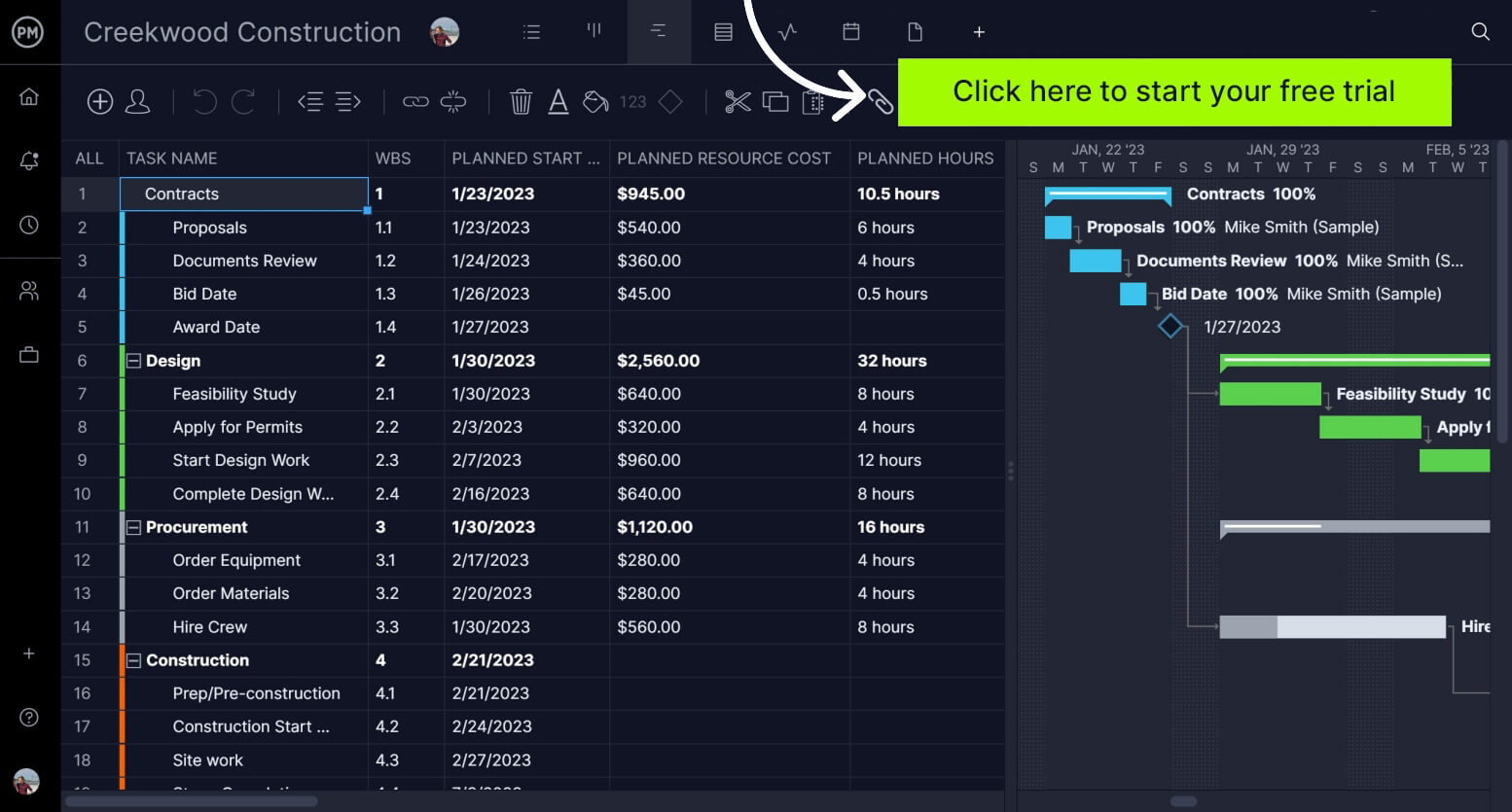

ProjectManager is award-winning project management software with robust Gantt charts that help you manage resources and costs in real time. You can organize your tasks and attach resources and costs to each. Link dependencies to avoid costly delays and even filter for the critical path to know which tasks are essential to project success. Once you set a baseline, you can then track your planned costs against actual costs in real time. Get started with ProjectManager today for free.

Types of Budgets

Considering that budgets can apply to so many diverse entities, it’s no surprise that there are many different types of budgets. Each of these budgets helps guide spending over the year so you don’t overspend. They’re crucial to making important financial decisions, but they differ based on various business and project needs.

Project Budget

A project budget is used to estimate the costs of a project. It’s created by the project manager and used to track costs throughout the execution phase of the project and make any adjustments that’ll keep the project on track financially. The project budget breaks down costs to individual tasks and the resources required to complete them.

Master Budget

As the name suggests, the master budget is made up of all the individual budgets, such as sales, production, etc., that are used in a business. This is done to provide a full financial picture of the company and show how particular income and expenses fit in the business. A master budget is more commonly found in larger businesses, though a smaller company can use them to look at finances by category or department.

Operating Budget

An operating budget lists all the expenses and revenues a business estimates for its monthly or yearly operations. This is a way to understand how much money you need to operate your business well. The operating budget is made up of fixed costs and variable costs, revenue and unexpected expenses. They’re a combination of sales and production budgets, direct materials and labor and overhead and administrative expenses.

Related: Free Operating Budget Template for Excel

Sales Budget

The sales budget is concerned with estimating the revenue you expect to generate from sales and expenses over a period of time. By creating a sales budget, you can plan your spending and adjust it as needed. The more accurate your sales budget, the better you can ensure that you have the materials and inventory on hand to meet customer demand.

Financial Budget

A financial budget is used to determine how much money you need to achieve your short-term and long-term goals. It does this by looking at your assets, liabilities and equity. When this is done, you have a snapshot of your business’s health and whether it’s stable. A financial budget is often used when a business is looking for funding or positioning itself for an initial public offering (IPO).

Cash Flow Budget

Knowing the money that goes in and out of your business over a period of time is important, and a cash flow budget helps forecast that cash flow. Knowing your cash flow is critical to making important financial decisions, but it also helps find issues and prevent overspending. Ideally, you want to ensure that there’s enough money coming in to cover the money going out of your business. Negative cash flow is when you don’t have enough money to cover offset expenses.

Budgeting Methods

Budgeting methods are how you implement a budgeting process. Just as there are many types of budgets, there are many budgeting methods. And, as with the types of budgets, there’s not one right choice. You have to make that decision based on spending habits and strategic planning. Here are four budgeting methods to help you get started.

Zero Based Budgeting

Zero-based budgeting is simply income minus expenses equals zero. It’s one of the more common budgeting methods and starts with the assumption that all budgets are zero and are rebuilt from scratch. This creates a very tight budget and avoids any expenditures that aren’t necessary for a business’s success. It’s a bottom-up budgeting method that’s used for cost containment, but it’s time-consuming.

Incremental Budgeting

An incremental budget works by using the previous year’s actual figures and adding or subtracting a percentage of that to determine the current year’s budget. It’s a very common budgeting method as it’s simple and best used when primary cost drivers are unchanged from year to year. But it can perpetuate inefficiencies, result in budgetary slack and ignore external drivers of activity and performance.

Activity-Based Budgeting

Activity-based budgeting is a top-down approach. It determines the amount of inputs that are needed to support the outputs set by the business. The activities that incur costs are recorded, analyzed and researched. It’s a rigorous budgeting method that helps to reduce production costs while increasing production efficiencies and determines how to make products more cost-friendly.

Value Proposition Budgeting

When using value proposition budgeting, you’ll ask yourself why is this included in the budget, does it create value for the customer, staff or stakeholders and is the value of that item greater than its cost? If it’s not, what’s your justification for the cost? Asking these questions ensures that everything in your budget delivers value to your customers.

How to Make a Budget for a Project or Business in 6 Simple Steps

A budgeting process begins with making the budget. Whether you’re managing a business or a project, these are the six steps to follow to create a budget.

1. Choose a Budgeting Approach

As illustrated above, there are many approaches to making a budget. The budgeting process that’s right for you is the first step in defining your business or project budget. Look at your current financial situation and what your priorities are and choose a budget approach that matches your financial goals.

2. Define the Purpose of Your Budget

Again, there are various reasons for a budget such as a sales budget, operating budget, etc. Before you can start, you have to know what kind of budget you’re making. That’ll guide you through the budgeting process.

3. Make an Action Plan

Now that you have a method and a purpose, it’s time to create an action plan, which is the steps that’ll lead you to a completed budget. You’ll want to define the scope, such as the goals and planned deliverables. Then you’ll want to put this on a timeline to track your budget over a specific period.

4. Estimate Fixed and Variable Costs

First, fixed costs are those that aren’t changed such as your rent, utility bills, salaried payroll, insurance, interest on loans, property taxes, etc. Variable costs are those that can change, such as raw materials, labor, sales commissions, shipping, etc. Together, these will make up a great deal of your budget.

5. Estimate Expected Revenue

The expected revenue is the amount of money a company estimates it’ll generate from sales. It can be as simple as the number of units sold multiplied by how much were sold. But revenue doesn’t account for costs and expenses. Use historical data and market research to estimate what you expect to earn over the budgetary period.

6. Create a Contingency Fund

As you can see, all these figures are estimations. They should be as accurate as possible and based on research and data, but they’re not a given. That’s why it’s so important to have a contingency fund when creating a budget. It’s a sum of money put aside to compensate for the inaccuracy inherent in estimating costs and revenue in a budget as well as covering for risk.

How ProjectManager Helps With the Budgeting Process

ProjectManager is award-winning software that helps with the budgeting process. When you start a project either by importing an Excel or Microsoft Project file or by using one of our industry-specific templates, you can set the project budget. We’ve shown how you can plan your budget on Gantt charts that organize your tasks and their associated resources and costs. But there’s much more you can do to manage and track your costs throughout the project life cycle.

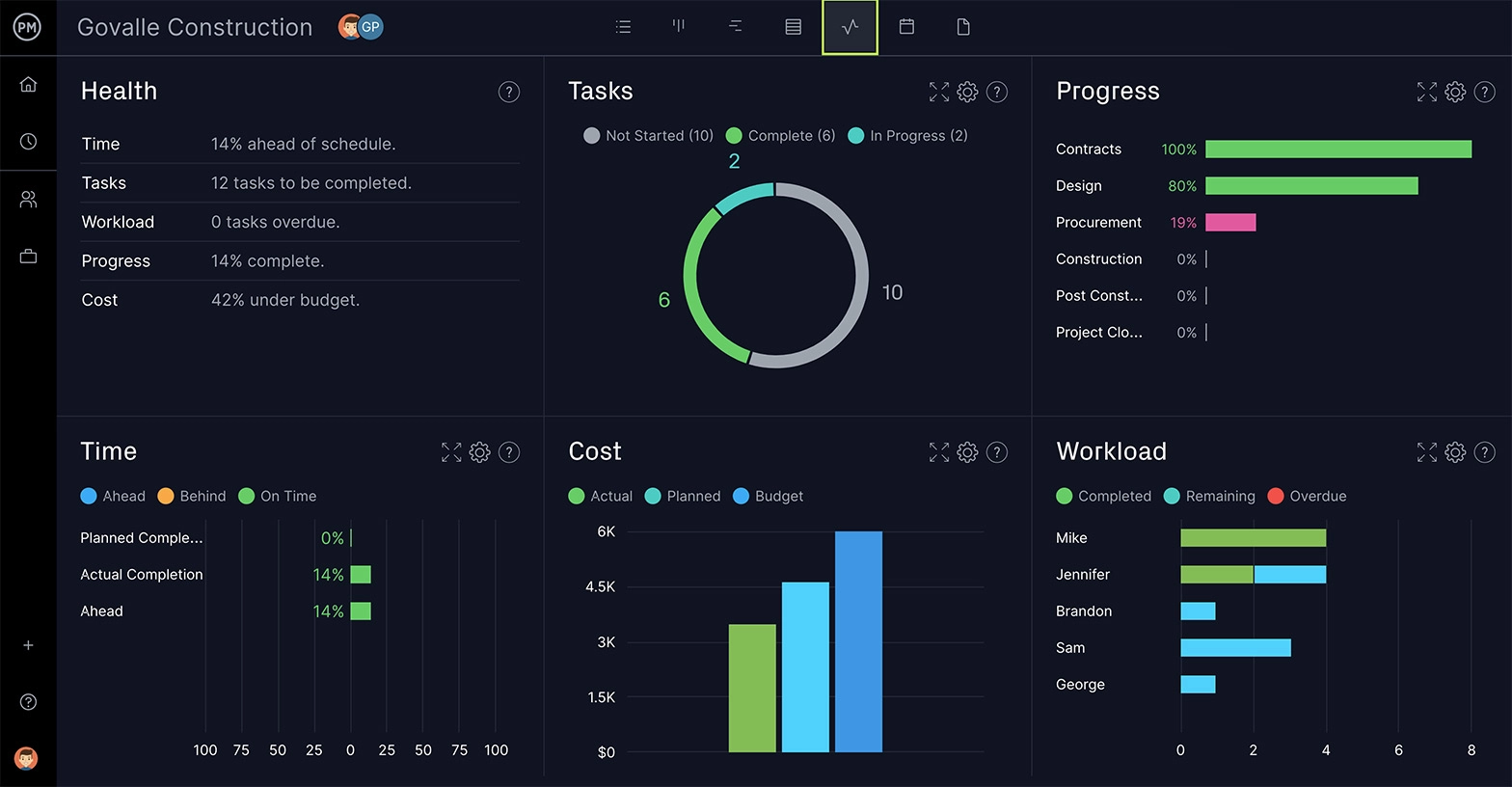

Monitor Costs With Real-Time Dashboards

The budgeting process is not restricted to planning, but must also monitor and change in order to avoid overspending. With our real-time dashboards, you can have a high-level overview of your costs as well as other metrics that can alert you of issues so you can resolve them quickly. Our live dashboard automatically collects real-time data and displays it in easy-to-read graphs and charts. Unlike lightweight software, there’s no lengthy configuration needed to set up our dashboard. It’s ready when you are.

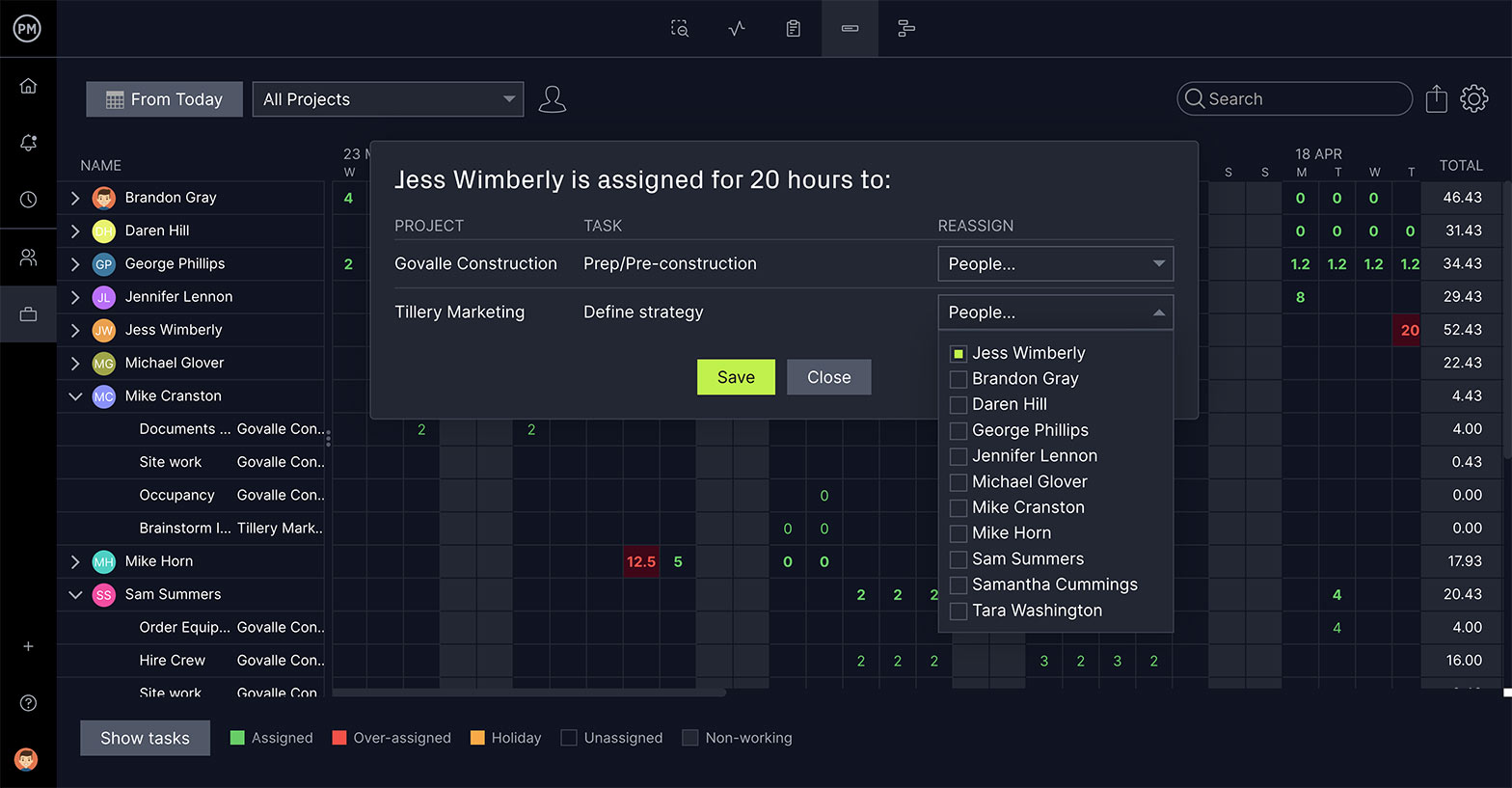

Use Timesheets and Workload Chart to Track Resources

Resources are anything you use to get your work done, from labor to materials and everything in between. It’s important to track your resources to keep to your budget, and our tool has resource management features that make it easy. When you onboard the team, you can add their availability, including PTO, vacations and global holidays, which makes it easier to assign them work. Our secure timesheets streamline payroll and allow you to view where each team member is in terms of completing their tasks so you can see if they’re on schedule. There’s also a color-coded workload chart that shows if anyone is overallocated. You can balance workloads right from the chart to keep them working at capacity without the expense of overtime.

Our resource management features help you stay on budget as do our task and risk management tools. If your team falls behind, that means extra money and issues can sidetrack your project and negatively impact the budget. Using our reporting features allows you to go deeper into the data than the dashboard and keep track of project status, variance and more. All reports are customizable to filter only the information you want to see and can be easily shared with stakeholders, who have a vested interest in your project.

ProjectManager is online project management software that helps plan, manage and track budgets in real time. Our collaborative platform allows you to share files, comment and more, connecting everyone regardless of whether they’re in the next office or a different location. Join teams at Avis, Nestle and Siemens who use our software to deliver success. Get started with ProjectManager today for free.