Producing things isn’t cheap. There are many costs that occur during production and it can be hard to track them all. These costs are what is called manufacturing overhead.

Let’s define manufacturing overhead, look at the manufacturing overhead formula and how to calculate manufacturing overhead.

What Is Manufacturing Overhead?

Manufacturing overhead is the sum of all the manufacturing costs except direct labor or direct materials costs. This is why manufacturing overhead is considered an indirect cost.

Manufacturing overhead costs include selling, general and administrative expenses, such as corporate salaries, audit and legal fees, are simply recorded as expenses and are added to the income statement for the accounting period in which they occur.

Manufacturing overhead is added to the units produced within a reporting period and is the sum of all indirect costs when creating a financial statement. It’s added to the cost of the final product, along with direct material and direct labor costs. According to generally accepted accounting principles (GAAP), the manufacturing overhead appears on the balance sheet as the cost of a finished goods and work-in-progress inventory as well as the cost of the goods income statement.

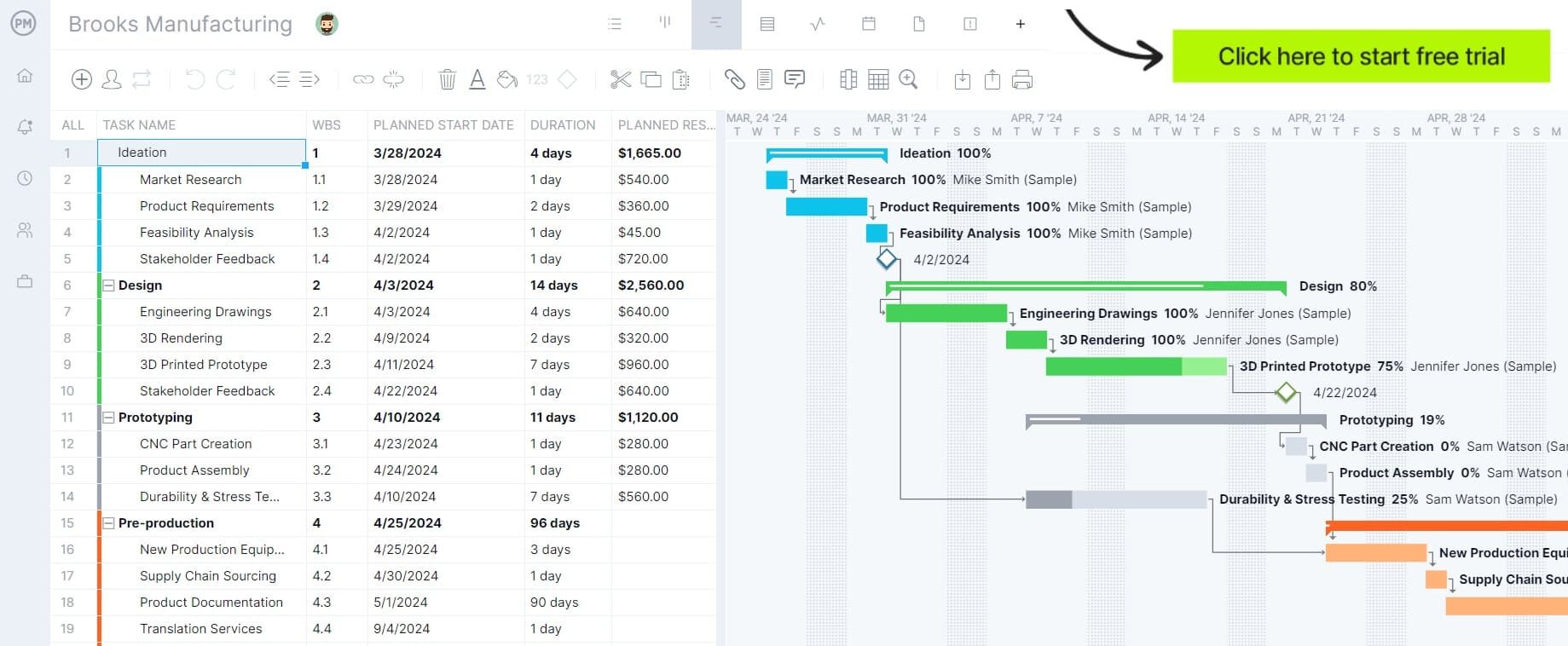

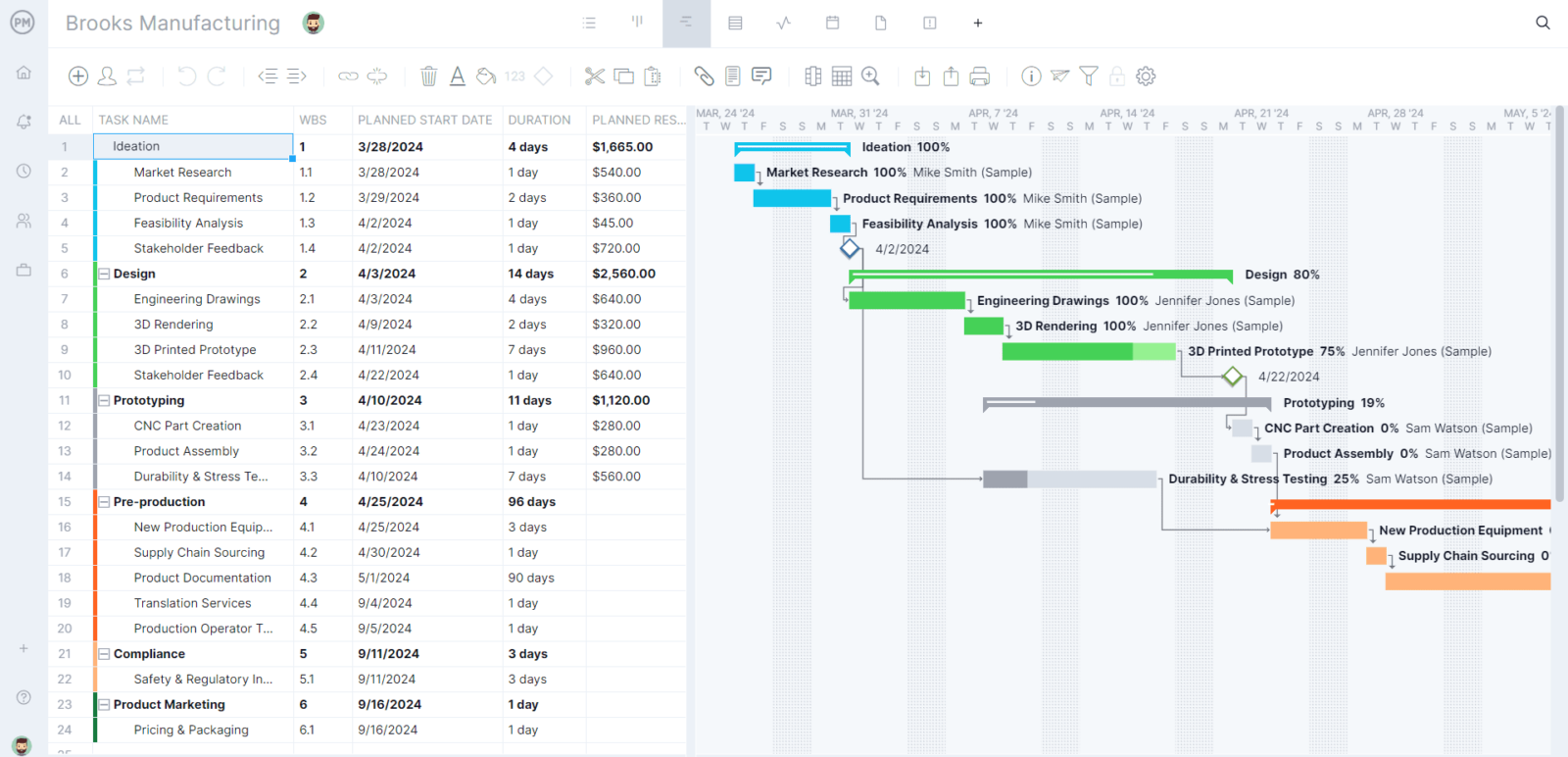

The ability to track those costs is important and project management software can help. ProjectManager is online work and project management software that delivers real-time data to monitor costs as they happen. While we have many project views, the Gantt chart contains key details on how much you’re spending on production. Use it to centralize manufacturing processes and collaborate with your team so you know how much you’re spending during production. Get started with ProjectManager for free today.

Examples of Manufacturing Overhead Costs

Some other examples can include the rent you pay on your factory building, supplies that are not directly associated with products and wages of people who work in the plant but are not directly creating products.

If you’d like to know the overhead cost per unit, divide the total manufacturing overhead cost by the number of units you manufacture. To know the exact number of units to manufacture for the next quarter, make a production budget.

How to Calculate Manufacturing Overhead

The first thing you have to do is identify the manufacturing overhead costs. These are the indirect costs that help run the manufacturing facility. All these indirect costs are added together. Now that you have an estimate for your manufacturing overhead costs, the next step is to determine the manufacturing overhead rate using the equation above.

When you do this calculation and find that the manufacturing overhead rate is low, that means you’re running your business efficiently. The higher the percentage, the more likely you’re dealing with a lagging production process.

This not only helps you run your business more effectively but is instrumental in making a budget. Knowing how much money you need to set aside for manufacturing overhead will help you create a more accurate budget.

Manufacturing Overhead Formula

First, identify the manufacturing expenses in your business for a given period. Once you do, add them to find your total manufacturing overhead cost.

There are various formulas you can use to calculate the manufacturing overhead costs of your business, but the most commonly used method is the total manufacturing overhead formula:

Total Manufacturing Overhead Cost = Indirect Labor + Indirect Materials + Any Other Fixed or Variable Manufacturing Overhead Costs

Manufacturing Overhead Per Unit Formula

If you’d like to know the overhead cost per unit, divide the total manufacturing overhead cost by the number of units you manufacture.

Manufacturing Overhead Per Unit = Total Manufacturing Overhead / Number of Units Produced

Get your free

Production Schedule Template

Use this free Production Schedule Template for Excel to manage your projects better.

What Is Included in Manufacturing Overhead?

Manufacturing overhead is referred to as indirect costs because it’s hard to trace them to the product. A final product’s cost is based on a pre-determined overhead absorption rate. That overhead absorption rate is the manufacturing overhead costs per unit, called the cost driver, which is labor costs, labor hours and machine hours.

Five basic types of costs are included in manufacturing overhead, which are as follows:

Indirect Labor

These are costs that the business takes on for employees not directly involved in the production of the product. This can include security guards, janitors, those who repair machinery, plant managers, supervisors and quality inspectors. All their salaries are considered indirect labor costs. Companies discover these indirect labor costs by identifying and assigning costs to overhead activities and assigning those costs to the product. That means tracking the time spent on those employees working, but not directly involved in manufacturing.

Indirect Materials

These are costs that are incurred for materials that are used in manufacturing but are not assigned to a specific product. Those costs are almost exclusively related to consumables, such as lubricants for machinery, light bulbs and other janitorial supplies. These costs are spread over the entire inventory since it is too difficult to track the use of these indirect materials.

Utilities

Costs associated with utilities can be hard to calculate as they fluctuate with the number of materials being produced. Therefore, natural gas, electricity and water are overhead costs, but they aren’t constant. You might need more or less, for example, depending on the demand for your product in the market. This makes them variable overhead costs. They are calculated for the whole facility and then allocated over the entire product inventory.

Related: 10 Free Manufacturing Excel Templates

Physical Costs

These physical costs are calculated either by the declining balance method or a straight-line method. The declining balance method involves using a constant rate of depreciation applied to the asset’s book value each year. The straight-line depreciation method distributes the carrying amount of a fixed asset evenly across its useful life. The latter is used when there is no pattern to the asset’s loss of value.

Financial Costs

As the name implies, these are financial overhead costs that are unavoidable or can be canceled. Among these costs, you’ll find things such as property taxes that the government might be charging on your manufacturing facility. But they can also include audit and legal fees as well as any insurance policies you have. These financial costs are mostly constant and don’t change so they’re allocated across the entire product inventory.

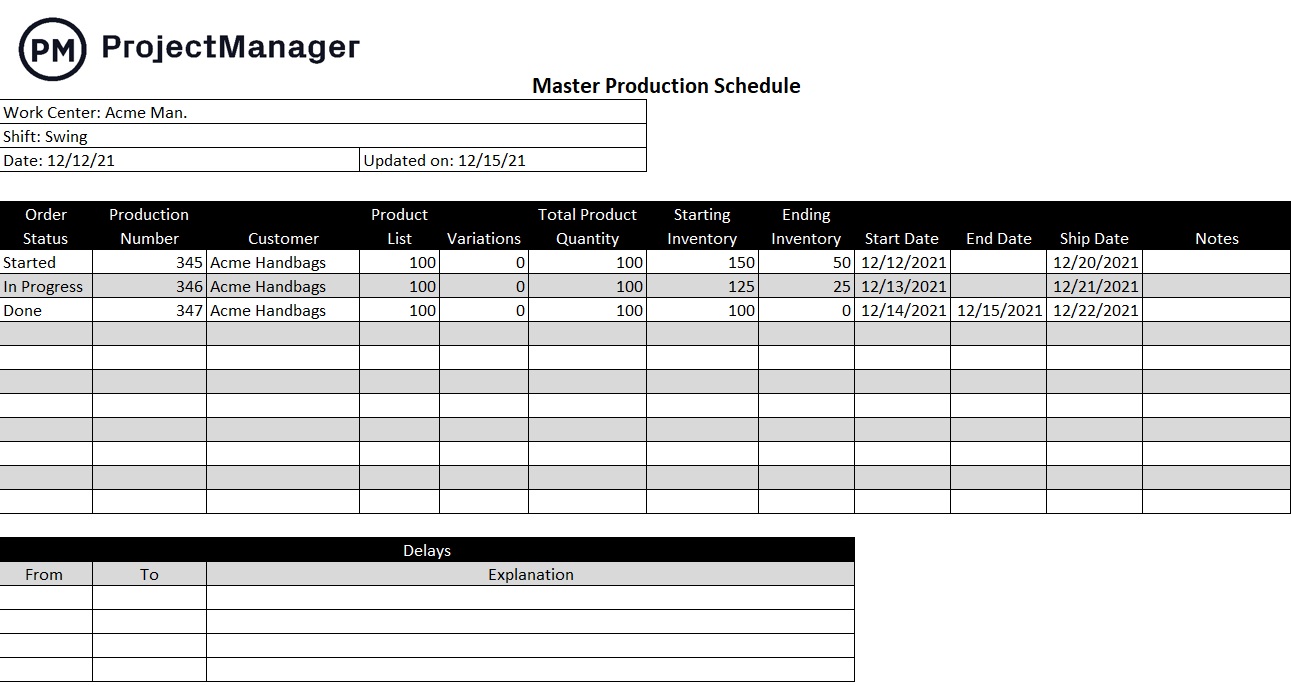

Free Production Schedule Template

Calculating manufacturing overhead is only one aspect of running an efficient and profitable project. You also need to closely monitor your production schedule so you can make adjustments as needed. Download our free production schedule template for Excel to monitor production dates, inventory and more.

Examples of Manufacturing Overhead Costs

Now that we’ve defined the main types of manufacturing overhead cost categories, let’s look at 10 examples of fixed and variable manufacturing overhead costs.

Fixed Manufacturing Costs Examples

- Real estate taxes

- Factory Insurance

- Depreciation of production facilities and capital assets

- Legal fees related to regulatory compliance

- Rent of production facilities

Variable Manufacturing Costs Examples

- Indirect materials

- Indirect labor

- Factory utilities

- Warehousing, transportation and other logistics management costs

- Machinery and equipment supplies and consumables

How to Calculate Manufacturing Overhead

The manufacturing overhead rate is the ratio between overhead costs and the value of goods sold, which allows manufacturers to gauge the impact that overhead costs have on the profitability of their manufacturing operations.

Manufacturing Overhead Rate Formula

You can find the overhead rate of your manufacturing operations using the following formula.

Manufacturing Overhead Rate = Fixed Overhead Costs + Sales * 100

Predetermined Manufacturing Overhead Rate Formula

You can also use the formula below to calculate a predetermined manufacturing overhead cost rate that will be allocated to all the units that are produced instead of allocating overhead costs to each of them.

This is done by production managers so they can easily calculate their cost of goods sold and cost of goods manufactured. A predetermined manufacturing overhead rate can also be helpful when making a manufacturing overhead budget.

Predetermined Manufacturing Overhead Rate = Budgeted Overhead / Budgeted Activity Level

Note: The activity level can be represented in terms of the machine hours or direct labor hours that will be utilized to manufacture products.

What Is a Manufacturing Overhead Budget?

A manufacturing overhead budget covers all fixed, variable and applied manufacturing overhead costs of an organization. These costs are then allocated to each unit that’s produced and documented as part of the cost of goods sold in a manufacturer’s master budget.

The costs from the overhead budget are also used for calculating the cost of finished goods inventory, which goes into the budgeted balance sheet. Additionally, this budget will allow you to calculate a predetermined manufacturing overhead rate, which you can then use to measure your production costs.

Manufacturing Overhead Budget Example

A manufacturing overhead budget should include the following elements:

- Budgeted direct labor hours

- Predetermined variable manufacturing overhead rate

- Total variable manufacturing overhead

- Total fixed manufacturing overhead

- Total manufacturing overhead

- Capital assets depreciation

- Cash disbursements for manufacturing overhead

Most manufacturing overhead budgets cover a year, but each of these values are calculated quarterly. Here’s what a sample manufacturing overhead budget looks like. To make this sample manufacturing overhead budget, we’ve included a predetermined variable manufacturing overhead rate which we multiplied by the total direct labor hours for a quarter to find the applied variable manufacturing overhead.

Then we added the fixed manufacturing overhead for each month to obtain the total manufacturing overhead values. Finally, we deducted the monthly depreciation value from the capital assets and organizational resources to find the actual cash paid for manufacturing overhead.

Types of Manufacturing Overhead

The total manufacturing overhead of an organization can be divided into subcategories: fixed manufacturing overhead, variable manufacturing overhead and applied manufacturing overhead for more thorough cost tracking.

You may also track the manufacturing overhead rate of your production process to determine the degree to which overhead costs increase the cost of manufacturing your products.

Fixed Manufacturing Overhead (FMOH)

The term fixed manufacturing overhead refers to all factory overhead costs that do not depend on the production volume of a manufacturing business.

Some examples of fixed manufacturing costs include the rent of the production facility, salaries of members of the production department that aren’t directly involved in the manufacturing process or the depreciation of capital assets.

Variable Manufacturing Overhead (VMOH)

Variable manufacturing overhead is the sum of all the factory overhead costs that vary depending on the production volume of the organization but aren’t related to resources that are used directly for the production of goods.

Some examples of variable manufacturing overhead costs are the cost of utilities such as electricity, water or fuel to operate machinery and supplies such as protective equipment or sales commissions.

Applied Manufacturing Overhead

The term applied manufacturing overhead refers to a method of calculating factory overhead that’s unique to the cost-accounting method in which overhead costs are allocated to a specific production order, product or department within a company.

This method allows organizations to better allocate their overhead costs and determine which processes or products are most impacted by them.

Applied Manufacturing Overhead Formula

This is the formula to calculate applied manufacturing overhead in manufacturing.

Applied overhead = estimated amount of overhead costs / estimated activity of the base unit

Manufacturing Overhead Calculation Example

Let’s now look at an example of manufacturing overhead. Consider Tillery Manufacturing, a business that makes shoes. In a good month, Tillery produces 100 shoes with indirect costs for each shoe at $10 apiece. The manufacturing overhead cost would be 100 multiplied by 10, which equals 1,000 or $1,000.

Now, what is the percentage of that? First figure out your monthly sales. Let’s say you sell 50 shoes each month. Therefore, the percentage is 1,000 divided by your monthly sales of 50 multiplied by 100 equals 5000. That gives you a percentage of two percent, which is very good. Your fantasy manufacturing business is very efficient!

How ProjectManager Helps With Manufacturing Costs

ProjectManager is cloud-based software that keeps everyone connected in your business. Salespeople on the road are getting the same real-time data that managers and workers are the floors are using to run production. ProjectManager has the tools you need to keep monitor and control all your costs, including your manufacturing overhead.

Manage Planned and Actual Costs on Interactive Gantt Charts

Once you set a baseline to capture your schedule, planned costs and actual costs can be compared to ensure you’re keeping to your budget. You add the hourly rate of your work and then assign their hours, which will then populate the Gantt and the sheet view (like the Gantt but without a graphic timeline). You can also track non-human resources, such as equipment, suppliers and more.

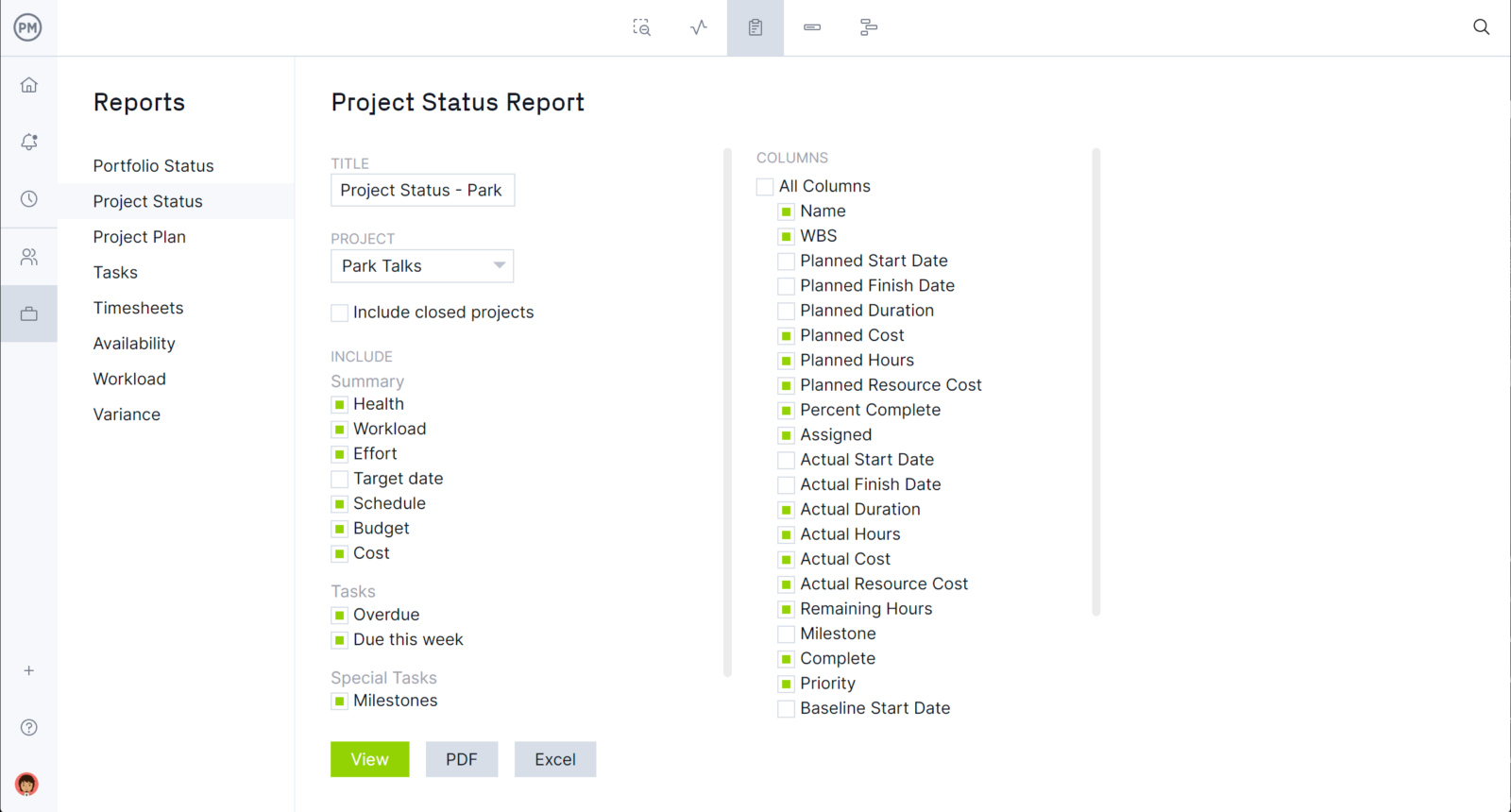

Track Costs With One-Click Reports

As mentioned above, you can track costs on the real-time dashboard and real-time portfolio dashboard, but you can also pull cost and budget data in downloadable reports with a keystroke. Get reports on project or portfolio status, project plan, tasks, timesheets and more. All reports can be filtered to show only the cost data and then easily shared by PDF or printed out to update stakeholders.

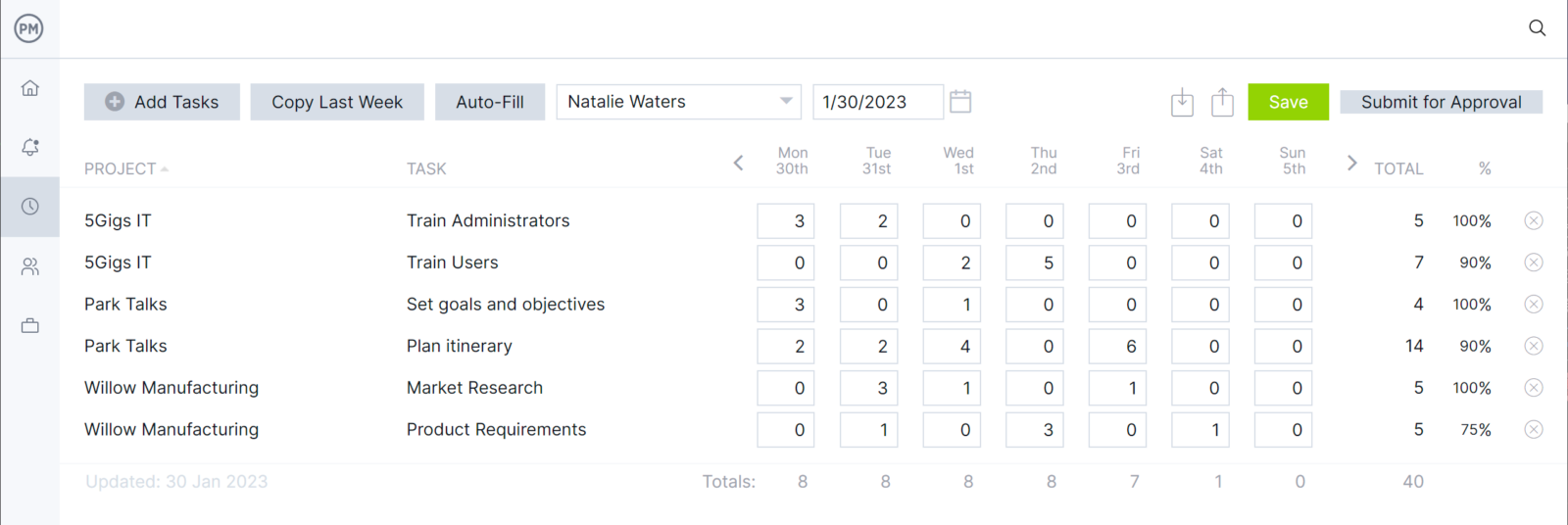

Streamline Payroll With Secure Timesheets

Our timesheet feature is a secure way to track the cost and the time your team is putting into completing their tasks. Teams can log hours or managers can set their hours. Once the timesheet is submitted, it’s locked for security. You can even set reminders for timesheets to make sure that everything runs smoothly.

There are other notifications you can receive by email or in the tool to alert you about activity and task reminders. Our collaborative platform lets you share files and comments with everyone no matter where or when. There are also workflow automation and task authorization features to free up your workers to focus on what matters without jeopardizing quality. You get it all with ProjectManager.

ProjectManager is award-winning work and project management software that connects teams with collaboration tools and a single source of truth. With features for task and resource management, workload and timesheets, our flexible software can meet the needs of myriad industries. Join the teams at Seimens, Nestle and and NASA that have already succeeded with our tool. Get started with ProjectManager today for free.